Are you familiar with the concept of “the velocity of money”? If not, stop right now, and go read this essay by billionaire Nick Hanauer called Want to grow the economy? Tax rich people like me. Go ahead, I’ll wait.

Back? Good. It should be clear now that a higher velocity of cash (how many times it changes hands before coming to rest) is better for the economy, and that part of the problem with the wealthy hoarding cash is that it reduces cash velocity to near zero.

Now, let’s look at the banking crisis in 2007. Per Wikipedia:

The 2007–2008 financial crisis, or Global Economic Crisis (GEC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers,[1] excessive risk-taking by global financial institutions,[2] a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a “perfect storm”, which led to the Great Recession.

In simpler language, big banks knowingly took on higher and higher risk assets, and when the expected failure of those assets occurred, the banks went begging to the US government for taxpayer dollars to help them stay alive.

Now, there were two different perspectives you could have taken on the issue:

- The banks are loaded with bad paper debt, so let’s give them a big ass check to cover that debt.

- A ton of homeowners are loaded with predatory debt they can’t pay, causing the banks to fail, so let’s cut them checks to cover their bad debt, which in turn makes the banks whole as well.

In the first scenario, we see a velocity of near zero. The bank gets the money with no interactions along the way, while the homeowners are left in default. In the second scenario, the homeowners keep their home, the banks still get paid and have their bad paper covered, and the surplus of cash at the homeowner level grows the economy in total since more high velocity cash is flowing through it on the way back to the top.

Naturally, our government went with option A.

Now, let’s run some numbers here: the TARP program, one of several massive bank bailouts created by Presidents Bush and Obama, authorized 700 billion dollars to buy up bad debt from the banks. An alternative approach authorizing income and cost of living based subsidies to homeowners averaging around $3000 per month could have assisted roughly 19.5 million households, or roughly a quarter of all owner occupied homes. 6.4 million foreclosures occurred between 2007-2009, meaning that even a third of the TARP budget as a subsidy to homeowners would have kept as many 20 million US residents in their homes.

It’s no coincidence that the spike in corporate owned single family housing occurred after this:

There were 10.9 million renters living in single-family homes in 2001, just under 30 percent of all renters (Figure 1). Following the Great Recession of the mid-2000s, the number of single-family rentals grew significantly, peaking at 15.2 million in 2016, as investors took advantage of the flood of distressed home sales during the foreclosure crisis.

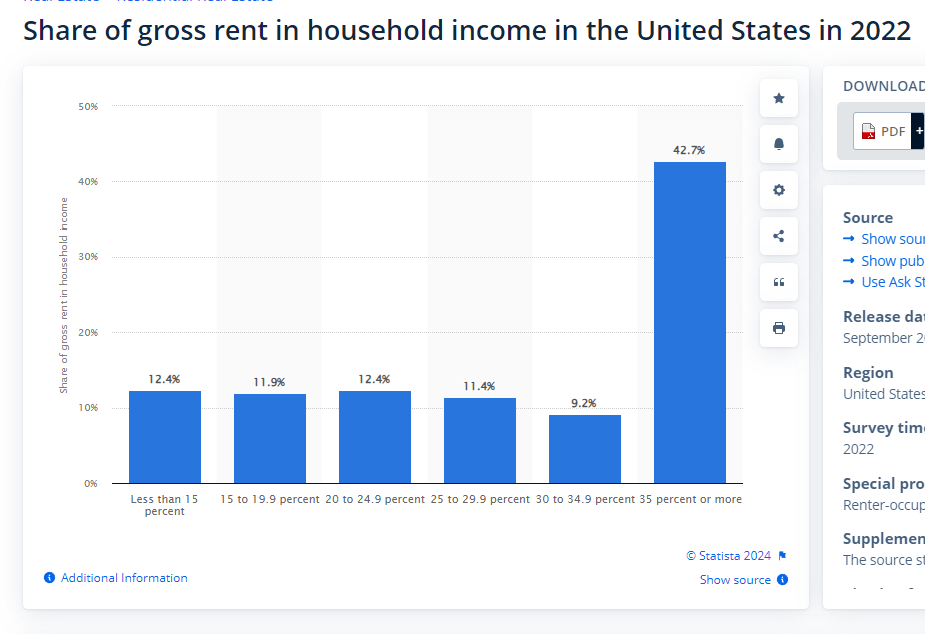

Combined with the effects of Covid, 25 percent of single-family rentals were owned by non-individual investors in 2021, up from 17 percent two decades earlier, precipitating predictable rises in rent as corporate interests gained greater control of inventory, and helping to drive inflation as rental costs reached nearly 50% of gross income for nearly half the renter occupied housing population.

We can see a clear line from a top only low velocity approach to shoring up the economy that has magnified wealth inequality, reduced average household wealth, and failed to do anything at all economically except generate record corporate profits while the average American is drowning in debt.

This is obviously unsustainable. Worse, it encourages the socialization of risk and privatization of profit approach that has become a de facto strategy for corporations deemed “too large to fail” in the US. To create a sustainable growth model which preserves the middle class, and provides real opportunity for upward mobility from the bottom quintiles, the US must prioritize high cash velocity policies, where every dollar has a multiple effect on GDP, and benefits a greater swath of the population.

Which brings us back to UBI.

Universal Basic Income, or “Guaranteed Income”, programs are highly variable. They’re often limited to certain segments of the population, most usually around those living below the poverty line, although some folks like Andrew Yang have proposed a thousand dollar a month basic income for all US citizens. Of all the pilot UBI programs tried in the US, however, they have one thing in common: they work. Despite the typical fear mongering around welfare queens and government checks being spent on liquor and tobacco, actual data gathered shows significant outcomes on a number of important measures, from childhood health to general quality of life improvements. UBI recipients gained enough flexibility to find better jobs, or complete higher education. And contrary to the thinly veiled racist claims that people given free money would become lazy and blow it on vices, the opposite proved true:

Recipients of the monthly payments were twice as likely to gain full-time employment than others, according to data analysis by a pair of independent researchers, Stacia West of the University of Tennessee at Knoxville and Amy Castro Baker of the University of Pennsylvania. Most of the money distributed was spent on food or other essentials. Tobacco or alcohol made up less than 1 percent of tracked purchases.

A bottom up high cash velocity program not only was NOT wasted and driving lazy unproductiveness, it quite literally led to higher employment, improving the tax base, and reducing the cost of social safety nets. And because that cash was distributed to the bottom quintile, it was immediately pushed back into circulation through necessary expenses, instead of sitting in a money market or account simply earning interest.

The data is readily available; UBI programs are not only the most effective policy to fight poverty, they also turn a social cost into meaningful contributions to the tax base, while simultaneously improving the average velocity of cash, and generating a higher quality of life and outcomes for most Americans. And, compared to bailout programs like TARP, they’re even more cost effective.

Poverty in the US is a choice made by those in power in an effort to protect their dragon horde of gold. The more hands a dollar passes through, the better off we all are. For 99.9% of Americans, implementing a UBI program will result in both a stronger economy, and a better society. It’s just common sense.